|

Rates your bank’s fee income production in 8 performance categories

and its growth over 3 time periods – nearly 200 measures by which to compare

and rate your bank against the industry… and all on only two pages.

Insurance

Fee Income Ratings Report Performance

Categories Include: Total

Bank Insurance Fee Income Bank

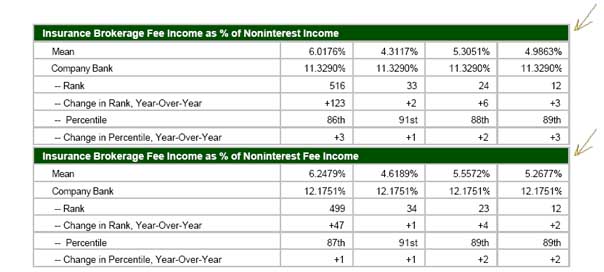

Insurance Fee Income as a percent of Noninterest Income Bank

Insurance Fee Income as a percent of Noninterest Fee Income Bank

Insurance Fee Income as a percent of Net Operating Revenue Bank

Insurance Fee Income per Bank Employee Bank

Insurance Fee Income per Domestic Office Bank

Insurance Fee Income as a percent of Retail Deposits Bank

Insurance Fee Income as a percent of Total Assets

Compound

Annual Growth Rate in Insurance Fee Income for 1, 2 and 3 years

Investment

Fee Income Ratings Report Performance

Categories Include: Total

Bank Investment Fee Income Bank

Investment Fee Income as a percent of Noninterest Income Bank

Investment Fee Income as a percent of Noninterest Fee Income Bank

Investment Fee Income as a percent of Net Operating Revenue Bank

Investment Fee Income per Bank Employee Bank

Investment Fee Income per Domestic Office Bank

Investment Fee Income as a percent of Retail Deposits Bank

Investment Fee Income as a percent of Total Assets

Compound

Annual Growth Rate in Investment Fee Income for 1, 2 and 3 years

Mutual

Fund and Annuity Fee Income Ratings Report Performance

Categories Include: Total

Bank Mutual Fund and Annuity Fee Income Bank

Mutual Fund and Annuity Fee Income as a percent of Noninterest Income Bank

Mutual Fund and Annuity Fee Income as a percent of Noninterest Fee Income Bank

Mutual Fund and Annuity Fee Income as a percent of Net Operating Revenue Bank

Mutual Fund and Annuity Fee Income per Bank Employee Bank

Mutual Fund and Annuity Fee Income per Domestic Office Bank

Mutual Fund and Annuity Fee Income as a percent of Retail Deposits Bank

Mutual Fund and Annuity Fee Income as a percent of Total Assets

Compound

Annual Growth Rate in Mutual Fund/Annuity Fee Income for 1, 2 and 3 years

Income

from Fiduciary Activities Ratings Report Performance

Categories Include: Total

Income from Fiduciary Activities

Bank

Income from Fiduciary Activities as a percent of Noninterest Income Bank

Income from Fiduciary Activities as a percent of Noninterest Fee Income Bank

Income from Fiduciary Activities as a percent of Net Operating Revenue Bank

Income from Fiduciary Activities per Bank Employee Bank

Income from Fiduciary Activities per Domestic Office Bank

Income from Fiduciary Activities as a percent of Retail Deposits Bank

Income from Fiduciary Activities as a percent of Total Assets

Compound

Annual Growth Rate in Investment Fee Income for 1, 2 and 3 years

|