|

The MWA Fee Income Ratings Report is the quickest way to determine how your bank is performing, and how

an institution's performance compares to banks across the country, region and state, and to similarly sized banks.

And you can even compare specific competitors and see how they are

doing.

IT'S A SCORECARD FOR YOUR BANK . . .

THAT CAN HELP YOUR TEAM ACHIEVE

A WINNING RECORD SEASON AFTER SEASON

Using data reported to the FDIC and the Federal Reserve Board by thousands of commercial banks, federally insured savings banks, and top-tier bank holding companies, our

Fee Income Ratings Report provides the benchmarks that bank management, bank directors and program managers find invaluable in assessing their program's performance, trends and possibilities. The

Fee Income Ratings Report compares, ranks and rates the particular institution by nearly 200 performance measurements. It also enables insurance company executives, investment product providers, third party marketers, and wholesalers to measure the competitive performance of their client banks, monitor the performance of their competitors' bank clients, and identify potential new prospects for their services.

-

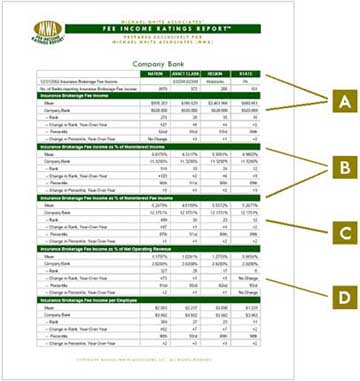

Compares your bank's insurance (or investment, or mutual fund and

annuity, or fiduciary-related) fee income performance to that of other banks earning insurance fee income and rates your bank's performance nationally, regionally, statewide, and in its asset-peer group.

-

Rates your bank's fee income production in

eight performance categories and its growth over three time periods - nearly 200 measures by which to compare and rate your bank against the industry and all on only two pages.

-

Ranks your bank numerically among all other banks with insurance income - in the country, asset class, region and state.

-

Reports your bank's year-over-year change in rank and, thus, its rise or fall in the standings.

-

Rates the bank's performance against others' by percentile. The 88th percentile documents performance in the top 12% of all banks.

-

Tracks the bank's year-over-year change in percentile, demonstrating its improvement or decline in performance relative to the marketplace.

-

Calculates your bank's growth in insurance fee income during one

year-to-date reporting period over the prior year and rates its growth against that of the industry.

-

Calculates the compound annual growth of the bank's insurance fee income over

year-to-date time periods, not just one year.

-

Measures your progress in building a business by comparing the bank's rate of growth to that of the industry.

-

Provides

an extensive glossary defining all terms and notations.

A

financial institution may wish to subscribe to more than one Fee Income Ratings Report

for several reasons. A bank may wish to see its own

ratings in insurance fee income and those of its parent bank holding

company. A bank holding company may wish to review its performance

not only in insurance, but also, for instance, in mutual fund and annuity fee

income and fiduciary income. Discounts are available for additional

subscriptions.

| Quantity |

Price

Per Report |

|

| 1 |

$250.00 |

|

| 2 |

$225.00 |

Save

10% |

| 3

- 4 |

$212.50 |

Save

15% |

| For

orders of 5 or more reports, further discounts are available -

call (610) 254-0440 for pricing. |

CLICK

HERE TO ORDER

ONLINE

|

|

BankInsurance.com�, Michael White Associates, MWA and all associated text, logos and images are protected by trademark and copyright.

� Michael White Associates, LLC 1997-. All rights reserved.

|